What Is the Real Cost of Copper Drawing?

In the wire and cable world, few processes look as deceptively simple—and as financially complex—as copper drawing. To the untrained eye, it’s just a heavy copper rod being pulled through a series of dies until it becomes a thin, uniform conductor. But for factory owners, plant directors, and purchasing managers, copper drawing is not just metal reduction. It is a high-stakes, margin-defining operation where every kilowatt, every liter of lubricant, every failure point, and every meter of scrap becomes part of a hidden economy.

This article takes a closer look at the real cost of copper drawing, going far beyond the obvious raw material price to reveal the operational, mechanical, and long-term financial factors that cable factories quietly confront every day.

Why Copper Drawing Matters More Than Ever

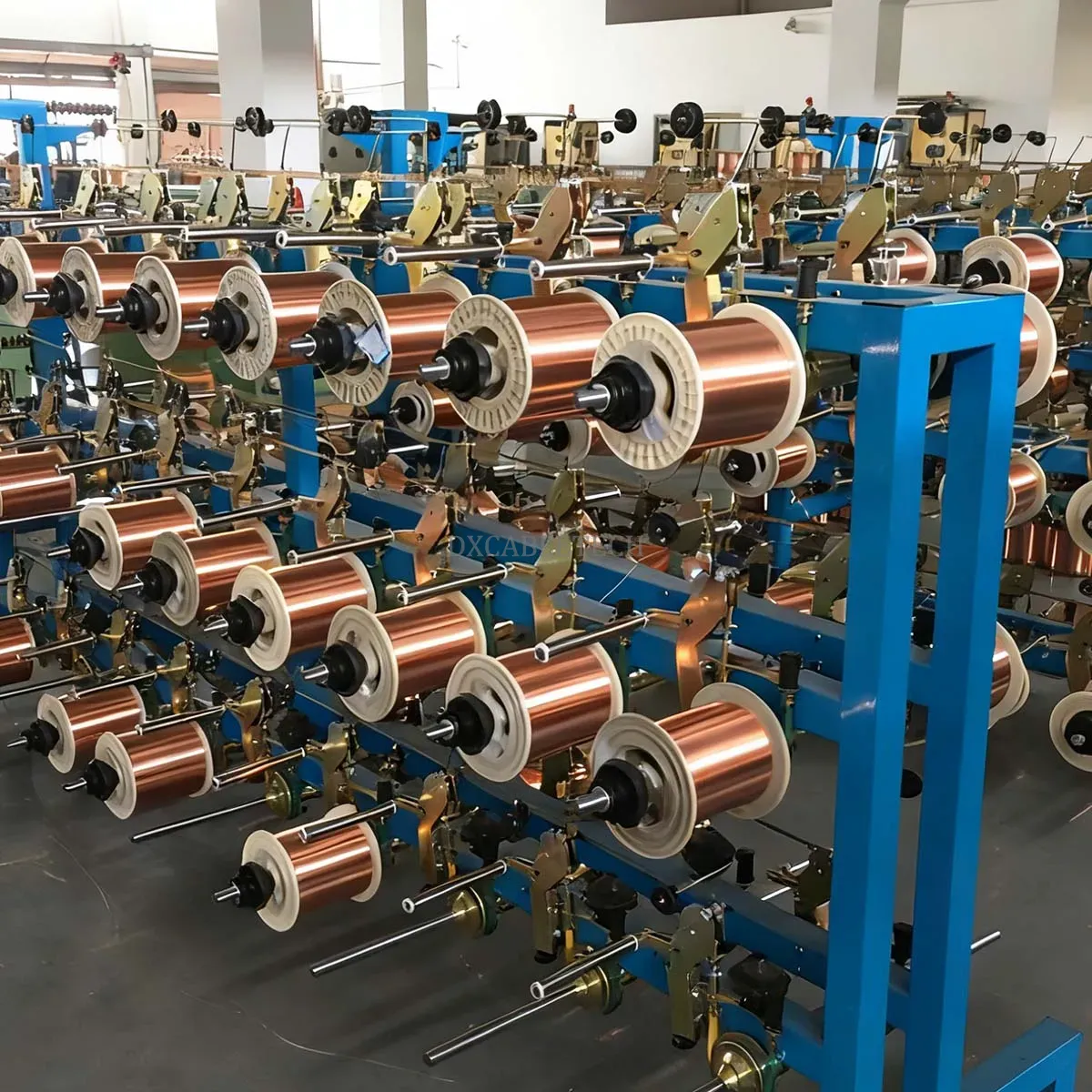

At its core, copper drawing—also known as rod breakdown, conductor reduction, or wire drawing—is the first and most essential step in cable manufacturing. Power cable, communication cable, new energy cable, EV charging cable, LAN cable, control cable: nearly every conductor begins as a thick copper rod drawn down to precise diameters.

But the real reason copper drawing is under scrutiny today is simple:

A 2% fluctuation in drawing efficiency can reshape an entire factory’s profitability.

In an industry where copper represents 70–80% of cable material cost, anything that affects yield, breakage rate, die life, or electrical properties has immediate financial consequences.

And that’s where the real story begins.

Section 1: The Hidden Operational Costs of Copper Drawing

1. Energy Consumption: The Silent Profit Killer

Copper drawing machines are energy-intensive systems. Motor drives, annealers, cooling systems, lubrication pumps—they all consume significant power. The cost varies by design, but the average factory faces:

• Large rod breakdown lines: 80–120 kWh per ton

• Medium drawing lines: 45–60 kWh per ton

• Fine wire drawing lines: 30–45 kWh per ton

For a medium-sized plant producing 600–1000 tons of copper wire monthly, energy alone becomes a six-figure expense.

But energy cost isn’t only about consumption. It’s also about stability:

• Poor tension control increases motor load

• Inconsistent annealing raises power requirements

• Old drives consume 15–20% more electricity

• Suboptimal lubrication increases friction and heat

In short, inefficient copper drawing quietly burns money every hour the line runs.

2. Die Wear: A Slow but Costly Erosion

The drawing die is the heart of any copper drawing line. Made from tungsten carbide or diamond, it determines diameter accuracy, surface finish, and tensile properties. But dies wear rapidly under high pressure and friction.

Every time a die loses precision by microns, the cost stacks up:

• Increased scrap rate

• Out-of-tolerance conductor diameter

• Higher drawing load = more energy consumption

• Possible breaks = more downtime

• More frequent die replacement

Die life is influenced by:

• Lubrication chemistry

• Drawing speed

• Copper purity

• Cooling efficiency

• Operator experience

Most factories underestimate how often they should rotate, polish, or replace dies. The result? Higher costs disguised as “normal production losses.”

3. Lubrication and Cooling: The Chemical Balance Sheet

Copper drawing relies on a delicate equilibrium of:

• Lubricants

• Emulsions

• Cooling water

• Filtration systems

• Additives

The real cost comes not from the chemicals but from improper maintenance:

• Degraded lubrication causes die burning

• Impurities reduce surface finish quality

• Poor cooling accelerates die wear

• Incorrect concentration increases breaks

• Bacterial growth destroys lubricant efficiency

A drawing line running on “dirty” lubrication can lose 8–12% productivity without the factory noticing the root cause.

4. Scrap and Breakage: The Most Expensive Waste

Every wire break stops production. Each stop interrupts annealing temperature. Each re-thread wastes time and materials.

Breakage cost is not just copper lost—it includes:

• Machine downtime

• Restarting operations

• Off-spec wire that must be reworked

• Increased operator workload

• Reduced final mechanical properties

A factory experiencing 3–5 breaks per shift may lose tens of thousands of dollars monthly.

Section 2: Mechanical and Technical Factors That Shape Cost

1. Machine Design: Single vs. Multi-Pass Efficiency

The geometry of a copper drawing machine deeply influences cost:

• The number of passes

• Capstan diameter

• Gearbox precision

• Type of annealer

• Speed synchronization

• Material of contact surfaces

A machine that was considered efficient a decade ago often cannot achieve today’s energy and quality requirements.

Newer lines deliver:

• 10–18% lower energy consumption

• Better diameter consistency

• Longer die life

• Higher speeds

• Lower breakage rates

• More automation = fewer operators

This is why many factories replace old 1990–2010-era lines: maintenance cost eventually exceeds the investment cost of upgrading.

2. Automation Level: PLC, Sensors, and Real-Time Controls

Modern copper drawing lines use advanced systems such as:

• PLC closed-loop tension control

• Laser diameter gauges

• Temperature feedback systems

• Load cell monitoring

• Intelligent lubrication control

• Automatic spool changeovers

These systems reduce the “human variable” that traditionally caused:

• Inconsistent drawing speeds

• Uneven annealing

• Bad lubrication balance

• Misaligned wire paths

• Delays in detecting diameter drift

Automation alone can reduce operational cost by 10–20%, depending on production scale.

3. Maintenance: A Cost That Multiplies When Ignored

Copper drawing lines rely on continuous mechanical movement. Bearings, rollers, motors, capstans, gearboxes—every component wears down.

Poor maintenance leads to:

• Increased energy load

• Frequent wire breaks

• Die misalignment

• Faster machine aging

• Lower conductor quality

• Reduced line speed

Yet maintenance is often under-budgeted, especially in small and medium factories.

The long-term financial impact is enormous.

Section 3: Labor, Skill, and Training Cost

1. Operator Skill Levels Matter

Many factories rely heavily on “old master” operators who learned by experience, not digital systems. However, modern copper drawing requires skill in:

• PLC interface operation

• Laser diameter gauge calibration

• Die management and inventory control

• Lubricant concentration measurement

• Tension synchronization

• Fault diagnostics

Skill shortages lead to:

• High scrap

• Unstable diameter

• Frequent downtime

• Unreliable annealing

Training has become a hidden, rising cost.

2. Safety Management

Copper drawing lines create real risks:

• High tension

• High temperature

• High voltage annealing

• Fast-moving wire

• Chemical lubrication

• Heavy rod loading

Accidents—rare but serious—bring:

• Direct injury cost

• Legal risk

• Compensation

• Operational downtime

• Damaged equipment

Safety training is not optional. It’s a cost-saving strategy.

Section 4: The Lifetime Cost of a Copper Drawing Machine

1. CapEx vs. OpEx

Most purchasing managers focus on the machine price. But the real question is:

How much does the line cost over 10 years of operation?

A cheaper machine may:

• Consume more power

• Require more operator intervention

• Wear out dies faster

• Break more frequently

• Deliver inconsistent quality

• Increase scrap rate

Over a decade, these hidden costs can exceed the purchase price several times.

2. Machine Reliability and Spare Parts

Imported machines, domestic machines, hybrid-control machines—all have different lifetime cost curves.

The two biggest hidden factors:

• Availability of spare parts

• Compatibility with modern control systems

Even a minor component—if difficult to source—can shut down a factory line for weeks.

Section 5: A Brief Industry Example (Light Mention)

Among many equipment makers, some manufacturers—such as Dongguan Dongxin (DOSING) Automation Technology—have worked on improving automation levels across wire and cable equipment, including areas adjacent to copper drawing. Their expertise in PLC-based intelligent systems and tension control reflects a broader industry movement: the shift toward more stable, data-driven production lines.

This example illustrates how modern control logic and optimized mechanical design can reduce long-term costs even in upstream processes like drawing, annealing, or wire preparation.

Section 6: When Copper Drawing Goes Wrong

An inefficient copper drawing operation shows itself in ways factories notice only too late:

• Surface scratches

• Elliptical wire shape

• Over-annealed or under-annealed wire

• High DC resistance

• Unstable elongation

• Die lines

• Frequent breaks

• Inconsistent lubrication

• High noise/vibration

• Capstan overheating

Each symptom carries financial weight. Each one impacts the cable’s final electrical and mechanical performance.

Section 7: The Real Economics of Copper Drawing

When all costs are included, the real financial model looks like this:

Direct Costs

• Energy

• Dies

• Lubricants

• Water and filtration

• Labor

• Spare parts

Indirect Costs

• Scrap

• Breakage

• Downtime

• Production fluctuations

• Maintenance

Hidden Costs

• Poor-quality copper wire affecting downstream processes

• Unexpected equipment failures

• Safety events

• Training gaps

• Inconsistent annealing

• Regulatory compliance

For a 10,000-ton per year cable factory, even a 1% improvement in copper drawing efficiency can add hundreds of thousands of dollars in annual profit.

That is the real cost—and real value—of copper drawing.

Conclusion: The True Cost of Copper Drawing Is a Strategic Choice

Copper drawing is no longer just the first step in cable manufacturing. It is a strategic, high-impact process that directly defines:

• factory efficiency,

• product quality,

• OPEX stability,

• and long-term competitiveness.

The factories that thrive in the next decade will be those that stop treating copper drawing as “just another workshop” and start treating it as a core financial engine.

Understanding the real cost of copper drawing—and optimizing it—is not optional. It is one of the clearest paths to profitability in the modern wire and cable industry.

Explore the complete cable manufacturing system:

→ Cable Manufacturing Process & Equipment Guide